Despite the high debt burden that new doctors take on, with careful planning, it is still a viable decision to borrow money for medical school. Minimizing debt during training and living reasonably until your loans are paid off are the cornerstones of managing the cost. If you do, you’ll be well on your way to financial success!

How Much does Medical School Cost?

The average medical school cost is $54,698 per year (2021), including tuition, fees, and room and board.

This means for a typical 4-year program, you can expect to pay about $218,792 to cover the cost of medical school. However, this number is a little misleading, predominantly due to the vast differences in cost between medical schools. While some private schools tip the scales at over $70,000 per year, others have famously done away with tuition altogether, although students are still responsible for room and board. That’s not an insignificant cost, either. Even with waived tuition, your living expenses can amount to tens of thousands of dollars, depending on the location of your school.

The bad news is that tuition, room, and board are only the tip of the iceberg. Tests and licensure fees are not usually included in the cost of tuition. Taking the MCAT will set you back $325 (2022) not including any money you spend on test prep courses or supplies. Of the United States Medical Licensure Exam’s parts, you’ll take the first two in medical school, and each costs $680 apiece. There’s also the cost of applying for a residency at the end of medical school. The range of what’s spent here varies widely depending on the number of programs applied to, travel expenses, and accommodations at each location. While the median cost of interviewing is about $4000, the amount can be as little as $1000 or as much as $13,000. There’s also the cost of books, supplies, uniforms, and other expenses to consider.

Options for Dealing with Cost: How to Pay for Medical School

When you add it all up, paying for medical school can seem like a formidable feat. However, there are strategies to help you minimize the amount of debt you take on during medical school and maximize your chances of being able to pay it back quickly after graduation.

Will I be able to keep working during medical school to make money?

It can be difficult to work during medical school, but that doesn’t mean it’s impossible. While you certainly shouldn’t work to the point where it negatively impacts your studies, with some discipline, more than a few students find ways to make a little extra money on the side. Many students will have summer between first and second year off, which can be a good opportunity to pick up some summer work and earn a little extra cash. I even knew of a few students who were nurses before medical school, and picked up occasional shifts during school to supplement their student loans. While this route certainly takes quite a bit of discipline, if you had a career before medical school, it is possible to keep working at least during your preclinical years on an as-needed basis to offset some of the cost.

Even working part-time at a job sounds tough! Are there any other options?

If you did not have a career before medical school, there are other opportunities to make money. Tutoring jobs are plentiful for medical students, whether with a test prep company for the ACT, SAT, or MCAT, or private tutoring for high school or university students. If tutoring isn’t your thing, creating content for test prep companies or websites can allow you to put your skills to work while helping you solidify your subject knowledge. If your school has an audio or transcription service for lectures, it can also be an opportunity for you to make money as well, whether it’s creating test prep guides or transcriptions of lectures for classmates. Even something as simple as pet-sitting while you’re studying can be a great way to earn a little money. Gigs like DoorDash or Uber are also popular means of earning a little extra when you need it.

What about online surveys or selling plasma?

Beyond typical jobs, medical students who are strapped for cash can sometimes complete online surveys, do paid research studies, or even sell plasma to pay for the cost of medical school. While these opportunities crop up from time to time, most pay inconsistently and probably shouldn’t be relied on as a primary source of income. It’s important to try to keep the cost of medical school in check, but it is worth remembering that you will in all likelihood be able to pay back your debt after school as long as you match and complete a medical residency.

How about medical school scholarships?

Scholarships for medical school, in general, are harder to come by than ones for undergraduate education. Due to the lower number of medical schools and the higher average competitiveness of applicants, merit-based scholarships are few and far between. Contacting the financial aid office at your school is usually a good place to start when it comes to looking for institution-specific scholarships. That being said, there are a handful of scholarships available for those with specific interests within medicine:

The Health Professions Scholarship Program is an option to pay for medical school if you are interested in joining the military following graduation. Students can receive a 2, 3, or 4-year scholarship that covers tuition, fees, and a living stipend for medical school in exchange for an equal number of years of military service. You must be eligible to join the US military to qualify for this scholarship.

For students planning on a future career as a physician-scientist, a combination degree might be funded by your institution. Most MD/Ph.D. programs offer a full-tuition scholarship and living stipend for the duration of the program. These programs are typically highly competitive and take only a few applicants each year. They also tend to be much longer than a traditional medical school program, due to the length of time it takes to complete your Ph.D. research – often closer to 8 years than the usual 4-year programs, not including residency.

If you are interested in providing primary care in an underserved region, the National Health Service Corps also offers to cover the full cost of tuition and fees as well as a living stipend. In exchange, you commit to a minimum of two years of service in a Health Professional Shortage Area for every year of scholarship support you receive.

Individual foundations and organizations also offer scholarships based on need, merit, or for individuals who are from a population that is underrepresented in medicine. These national scholarships are usually fairly small in number but can be substantial. Look for local organizations or check with your university’s financial aid office to uncover these opportunities.

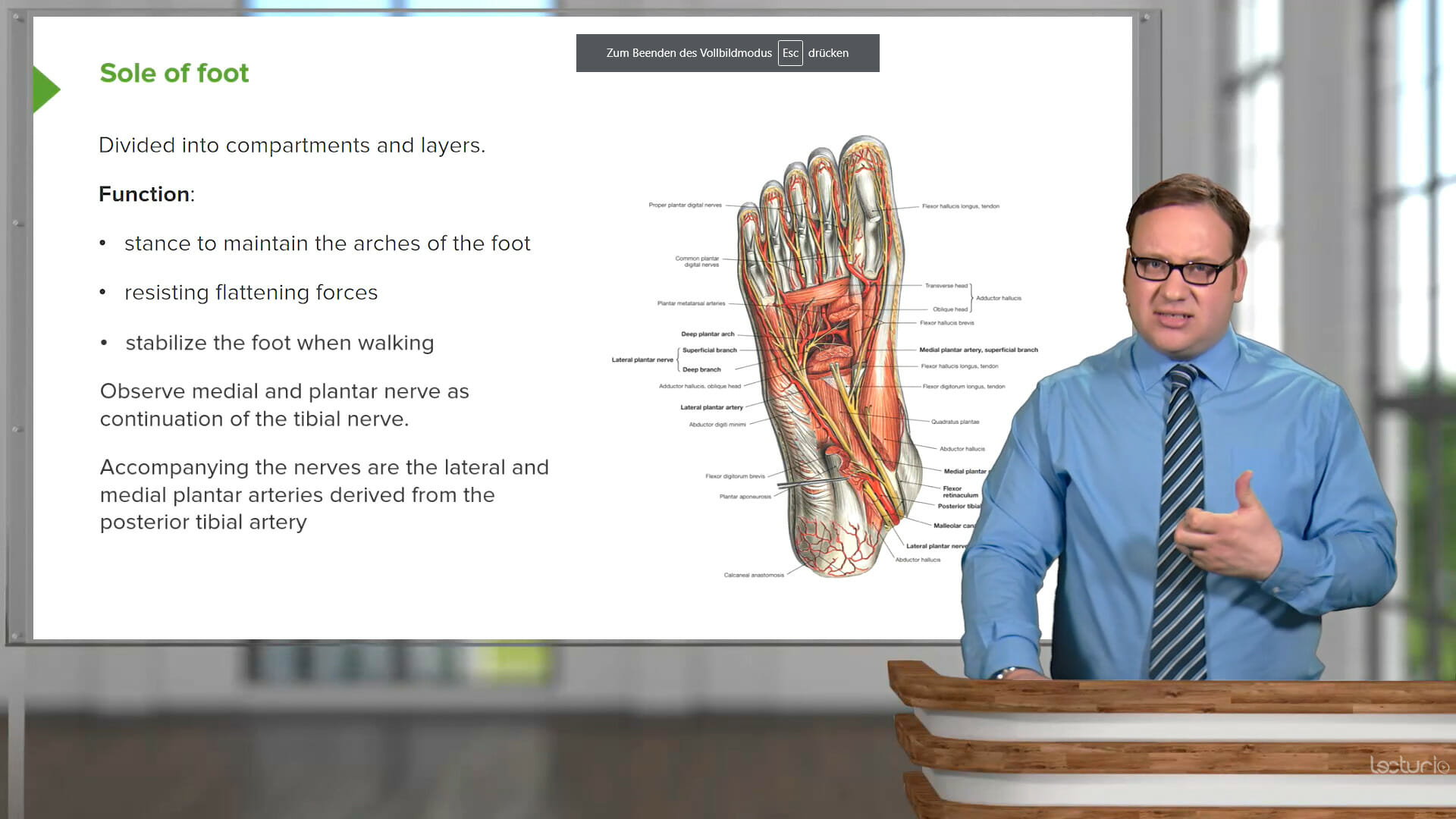

Studying medicine has never been easier.

Set yourself up for success with Lecturio.

Ways to Save Money During Medical School

Most people will not be able to obtain a full-tuition scholarship or make enough money to work their way through medical school. For the vast majority of medical students, the best way to reduce your student loan burden and to pay for medical school is to try to minimize the amount of debt you take on during your training. While the cost of tuition is not something you can control, your cost of living can vary widely depending on the type of lifestyle you choose during your training.

Live with roommates

For many students, the cost of living can be cut dramatically by choosing to live with roommates rather than alone during medical school – essentially by half! If you are married, have children, or living with roommates is not otherwise an option, subsidized graduate student housing that is offered by your university can be much cheaper than trying to find an apartment on your own. If you have a spouse who can work, this income can help keep costs down during your training.

Go without a car

If you can manage it, going without a car is another way to save money during medical school. If you don’t live in a large city with good access to public transportation, biking or rideshares can be an alternative to owning a car, especially if you use it infrequently. For many medical students, needing a car by the 3rd year is inevitable to get to clerkships and travel to and from the hospital. In this situation, buying a used or economy car is generally a better idea than trying to purchase a brand-new vehicle. While you might be making plenty of money someday, now is not the best time to buy that BMW of your dreams!

Pack a lunch

Packing a lunch and patronizing the “free food” events that are ubiquitous at every medical school program are also ways to save a little every day. You should also try to take advantage of lunch that is offered at Grand Rounds at the hospitals where you do your clerkships or the hospital cafeteria if you have a stipend available to you when you are on-call. Simple changes like brewing your coffee at home can also add up over time. The less you spend on take-out and restaurants, the less in debt you will have to pay back when medical school is over.

Buy used textbooks and equipment

Buying used textbooks and equipment is a tried-and-true method of saving money in medical school as well. While some medical material changes from year to year, the vast majority of the foundational knowledge that you’re building in medical school will not be impacted if you have a book that is a year or two out of date. Older books are often much cheaper than the latest edition and might even be free from upperclassmen who are moving and are keen to get rid of their extra textbooks. For equipment like ophthalmoscopes, which are still required but are rarely used in clinical practice, borrowing them from a classmate can be a serviceable option. Making use of hospital-issued scrubs and uniforms and laundry services can also be a way to save money.

Make a careful decision about which school to attend

If you do have a choice between medical schools, make a careful decision about where to attend based on cost. In-state schools tend to be much cheaper than out-of-state, and public schools tend to be cheaper than private schools, but this is not always the case. Talking with someone at the financial aid department, especially if one school is making you a better offer than another, can help make things more equal in terms of scholarship support or financial aid.

Be especially wary of attending medical school in a high cost of living area, such as a major city. While tuition and fees might be lower, this advantage could be completely offset by the higher cost of living. While school prestige can certainly play a factor in terms of residency opportunities, keep in mind that any doctor who completes a residency program in the US and passes their licensure exam can practice independently after they complete their training, and prestige matters far less when you are out of school than it might to you when you are first making your school decisions.

Dealing With Debt After Medical School

Take stock of your situation

Once you graduate from medical school and head on to residency, it’s time to come up with a serious plan for dealing with your medical school debt. The first step is to take stock of your situation and see what financial shape you are in. How much is your total debt amount? Is the debt private student loan debt or federal debt? In general, private loans are not eligible for any sort of loan forgiveness that’s discussed frequently in the news. Federal loans, on the other hand, have a variety of ways that payments can be structured after graduation.

Student loan repayment plans

For federal student loans taken out for medical school, it’s important to familiarize yourself with the repayment plans offered by the federal government, as well as the Public Service Loan Forgiveness program. At the time you complete your training, you’ll have a six-month “grace period” where no initial payments will be due on your student loans. Following this grace period, you’ll be prompted to enter a repayment plan to begin to pay your loans back.

There are five basic types of repayment that the federal government offers for your loans:

- The standard repayment plan

- Forgiveness with income-based repayment (IBR)

- Forgiveness with pay-as-you-earn (PAYE)

- Forgiveness with revised-pay-as-you-earn (REPAYE)

- Forgiveness with income-contingent repayment (ICR)

You should carefully evaluate your financial situation before deciding on which payment plan to enter. The fact that you will likely be making far less as a medical resident than you will someday as an attending physician has significant implications on how to pay back your student loans effectively.

For the vast majority of medical residents making 50-60k a year, the payments required under the standard repayment plan will be too high to allow them to live comfortably.

The standard repayment plan calculates a monthly payoff amount designed to pay off your student loans over 10 years. For a student who took out an average amount of student loans for medical school, this would amount to over $2000 a month in loan payments – almost half of your salary as a resident! For most people, this would not allow them sufficient money every month to cover their living expenses.

In recognition of this problem, the federal government allows you to enter one of the alternate payment programs that are based on the amount of earned income you have following completion of school. During your residency training, your income will be low enough that you qualify for IBR, REPAYE, PAYE, or ICR. In each of these programs, your monthly payment will be a percentage of your yearly income rather than the full amount due under the standard plan, allowing you to use the rest of your money for living expenses. This approach can be useful during residency, when your income prevents you from being able to make the full payments under the standard plan on your loans.

In addition to limiting your monthly payment to a percentage of income, IBR, PAYE, REPAYE, and ICR all include a “forgiveness” portion of the program. Essentially, after a certain number of years of qualifying payments under each program, the remainder of the balance of your loans is forgiven. While this is fantastic news for lower-income workers with significant loan balances, there is a catch for doctors. While limiting your monthly payment to a portion of your income is very helpful during residency, once you complete training and start to earn a higher income, your payment will still be a percentage of your higher income and your monthly payment will significantly increase. This generally means that by the time you have satisfied the number of years required to earn loan forgiveness, you may have already paid off your loans in full.

If you are still interested in loan forgiveness as an option, the Public Service Loan Forgiveness program (better known as PSLF) is another option to consider. Once enrolled in a qualifying loan forgiveness program, participants in PSLF who make a total of 120 qualifying payments (approximately 10 years of payments) will have the remainder of their student loan balance forgiven. To qualify for PSLF, you must work for a qualifying 501(c)(3) nonprofit entity or a governmental organization for the entirety of the time you are making qualifying payments. Many (but not all) hospitals qualify for PSLF if you remain employed there following your residency, meaning that if you completed a 3-year residency and 3-year fellowship at a PSLF-qualifying institution, you could have your loans forgiven after 4 more years of working for a nonprofit. The details of the program are quite complicated, as evidenced by the low number of applicants whose forgiveness has been approved since the program started. If your application is approved, however, it could mean saving tens of thousands of dollars in payments.

A Word on Specialty Choice

It’s no secret that some medical specialties pay more than others. While choosing a specialty based on average income might seem like a good idea, it may not be as important as you think. Choosing a specialty you don’t like very much based on a high paycheck could leave you burnt out and unsatisfied in your job, leading you to cut back on hours or to leave medicine as a career altogether sooner than you otherwise would have. Many specialties with higher pay also require longer training periods, meaning you’ll have to continue to put off spending money or paying back loans for a few more years. You should weigh these tradeoffs carefully before choosing to pursue a fellowship or longer residency program mainly in hopes of a higher salary.

Paying for Medical School: Difficult, but Worth It!

There’s an entire industry of financial professionals dedicated to figuring out the complexities behind the repayment of student loans. One of the simplest methods to paying back your student loans is, in retrospect, also among the most obvious: continue to live like a resident for several years after becoming an attending physician. The concept is simple: continue to live on a resident salary for 2-5 years after becoming an attending, and use the difference between your attending salary and your resident salary to pay off the balance of your student loans. By avoiding spending large amounts of money on a brand new house or car immediately after coming out of residency, you can make large payments towards your student loans and have the debt paid off quickly – no fancy student loan forgiveness programs or paperwork required.